Are Partners Liable for Partnership Debts

Even where one business partner accumulates debt without the approval or involvement of the other partners all partners will be liable. 6- Which one of the following statements is true regarding a partners personal liability for partnership debts.

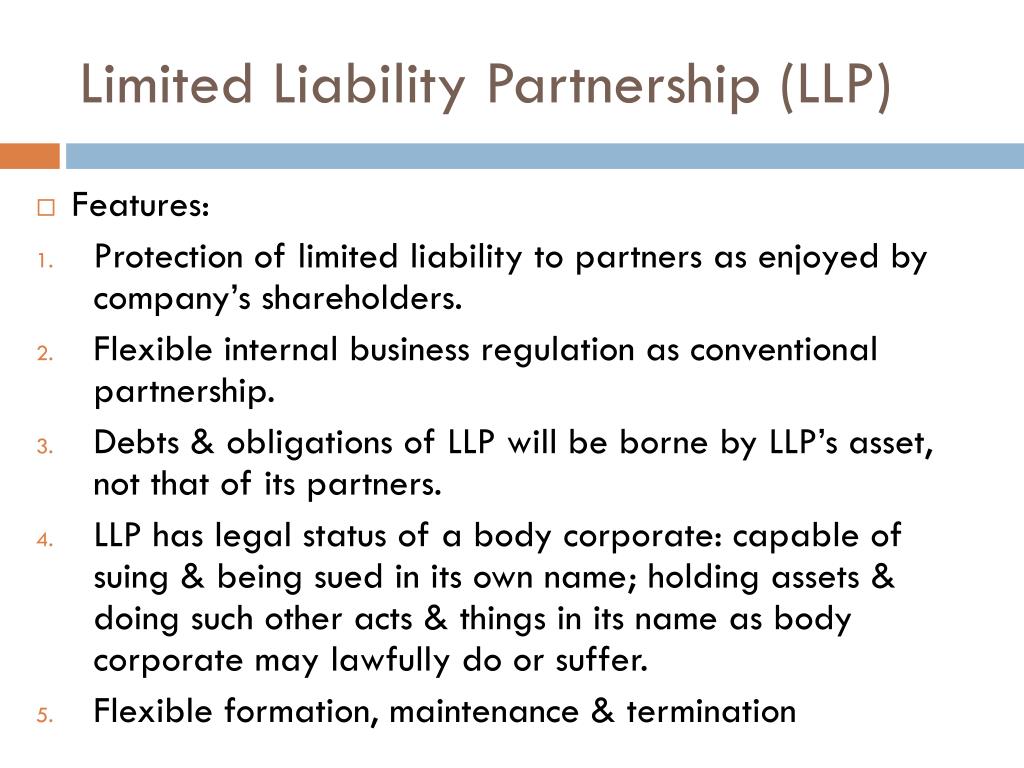

Advantages And Disadvantages Of Limited Liability Partnership

You are not just responsible for your debt and your actions in a General Partnership you are.

. A person who joins a partnership will not be liable for the debts it built up before they joined unless an agreement is made that says something different. Each partner has to be transparent and fully disclose the business of the partnership to other partners. Each partner must pay income tax on their own share of the firms profits.

General partner liability means when you enter a general partnership the personal liability you incur is unlimited3 min read. CIn a limited liability partnership a partner might be subject to liability for other. A partner who reires from the irm does not cease to be liable for partnership debts incurred before his reirement s172.

Every partner is severely and jointly liable for all acts of the firm done. Creditors can seize personal assets to pay off all of a companys debts not just the individuals pro rata share. By far the biggest point against a General Partnership is that without any sort of corporate entity being formed the partners have no corporate protections and they are personally responsible for all of the debt accumulated by the businesses and each of the General Partners.

In a general partnership a group of individuals enter into a partnership agreement to operate the business together with each partner specifically tasked with a certain role in the operation of the partnership. BIn a limited partnership all partners have limited liability for partnership debts. If one partner is taken out of action another can take over as well.

Partners are jointly and severally liable for the firms debts. Limited partnerships LPs and limited liability partnerships LLPs are both businesses with more than one owner but unlike general partnerships limited partnerships and limited liability partnerships offer some of their owners limited personal liability for business debts. When forming a partnership owners are usually required to sign a personal guarantee for loans leases and contracts especially if theyre part of a corporation or LLC.

O Incoming Partners are generally not Liable. The rule is that in a general partnership every partner is liable for all debts of the partnership. Also they can take action against more than one partner at.

Partners are personally liable for the business obligations of the partnership. This means that the firms creditors can take action against any partner. Therefore the individual partners are fully liable for the partnership debts if the partnership cannot meet them.

In the same way each partner is liable for 100 of partnership debts. The partners of sole proprietorships are each 100 responsible for debts. The General Partners Role in Limited Partnerships.

A partnerships debts are liable for the same amount owed by each partner in both cases. A person who leaves a partnership will still be liable for the firms debts. Since you are a general partner the IRS takes the position that you are.

AIn a general partnership all partners are liable for entity debts. If you have a partner she is a legal agent of your firm. If one of the partners has no assets and wants to go.

The general partners are personally liable for debts whereas limited partners arent. Partnership agreements can concisely outline the relationship between the partners each persons financial stakes how the venture will be managed and the. If you wanted to be shielded from liability the partnership should have been set up as a limited partnership with a general partner and limited partners whose only risk would be the loss of their investment.

Personal and Partnership Liability. But there are other liabilities too. A new partner is not liable to the creditors of the irm for anything done before he became partner s171.

A partnership is a trading entity made up of a number of individual members. In limited partnerships LPs at least one of the owners is considered a general partner who makes. Partner debtors are given the option of taking action against them.

They are also liable for the rest of the debt though one of the partners can pursue their own share of the debt. It is necessary to mention that all partners referred to as general partners personally are liable for all legal judgements. If youre planning to enter a partnership a written agreement is important.

Partners are joint several liable for the debts of the firm. Every partner is severely and jointly liable for business debts. This means all partners can be pursued for the debt.

Income tax liability Partners are not jointly and severally liable for income tax. A Business Partnership Agreement Is a Necessity. In insolvency there is no protection for each of the members of the partnership as in a limited liability company.

Every partner is to beat the loss of the firm in the agree proportion and in the absence agreement loss must be borne by all the partners equally. S17 Partnerships Act 1890. O Outgoing Partners Remain Liable.

A person who although not actually a partner is made liable for the debts of the partnership to third person by reason of his acts or omissions is called. If the creditors cannot get payment of the debt from one partner then they will pursue the other partner. That means you are individually and collectively responsible for any business debts the partner incurs.

No Need to Set Up a General Partnership. Partners will be held responsible for any debts incurred before they left the business. In this type of organizational structure each individual partner is personally liable for all debts and judgments against the partnership as a whole regardless of whether the debt.

When you are in a Partnership and you run into financial difficulty then both Partners become joint and severally liable for all of the business debts. It is not divided up. This means that if the partnership cant afford to pay creditors or the business fails the partners are individually responsible to pay for the debts and creditors can go after personal assets such as bank accounts cars and even homes.

Partnership Final Accounts Report Error Is there an error in this question or solution. This is true even after a partner has left the business. Any business debt which individual partners incur may be fully pursued against them.

Starting A Small Business Partnership Everything You Need To Know Business Structure Grow Business Small Business Success

Chapter 6 Types Of Business Organisation

Is A Partner Liable For The Partnership Ictsd Org

5 Lessons For Strong Business Partnerships Accountability Partner General Partnership Partners

Limited Liability Partnership Llp Partnership Structure Kalfa Law

Ppt Law Of Partnership Powerpoint Presentation Free Download Id 2257599

Business Ownership Structure Types Business Structure Bookkeeping Business Business Basics

Doc La Compania Maritima Vs Munoz Sarah Paclibar Academia Edu

What Is Partnership Firm Business Structure General Partnership Partnership

Doc What Is A Partnership Junjun Gangan Academia Edu

Limited Liability Partnerships Reports Acra

Understanding And Working With Limited Liability Partnerships

Choose A Business Structure For Your Online Business In 2021 Business Structure Online Business Business Tax

Partnership Bookkeeping Business Business Management Accounting

Is A Partner Liable For The Partnership Ictsd Org

What Are The Differences Between An Ordinary Partner And A Limited Partner Quora

Limited Liability Company Meaning Features Pros Cons Bookkeeping Business Limited Liability Company Business Tax

Comments

Post a Comment